FinCEN’s BOI Reporting Deadline: Boardman, OR Businesses Must Act by 01/01/2025

The Corporate Transparency Act (CTA) mandates businesses in Boardman, OR, to submit Beneficial Ownership Information (BOI) reports to FinCEN, a crucial step in curbing financial crimes such as money laundering and tax evasion.

As of today, 11-26-2024, Boardman business owners have 36 calendar days (or 27 business days) left to file their BOI reports with FinCEN—delays could cost $500 in daily fines!

Steps to Meet the BOI Deadline

1. Confirm Filing Requirements

Deadline: ASAP

Most corporations and LLCs are required to file unless exempt (e.g., banks, charities, publicly traded companies).

2. Identify Beneficial Owners

Deadline: 12-10-2024

A beneficial owner is anyone who:

-

Holds 25% or more of the company, or

-

Exercises substantial control over operations.

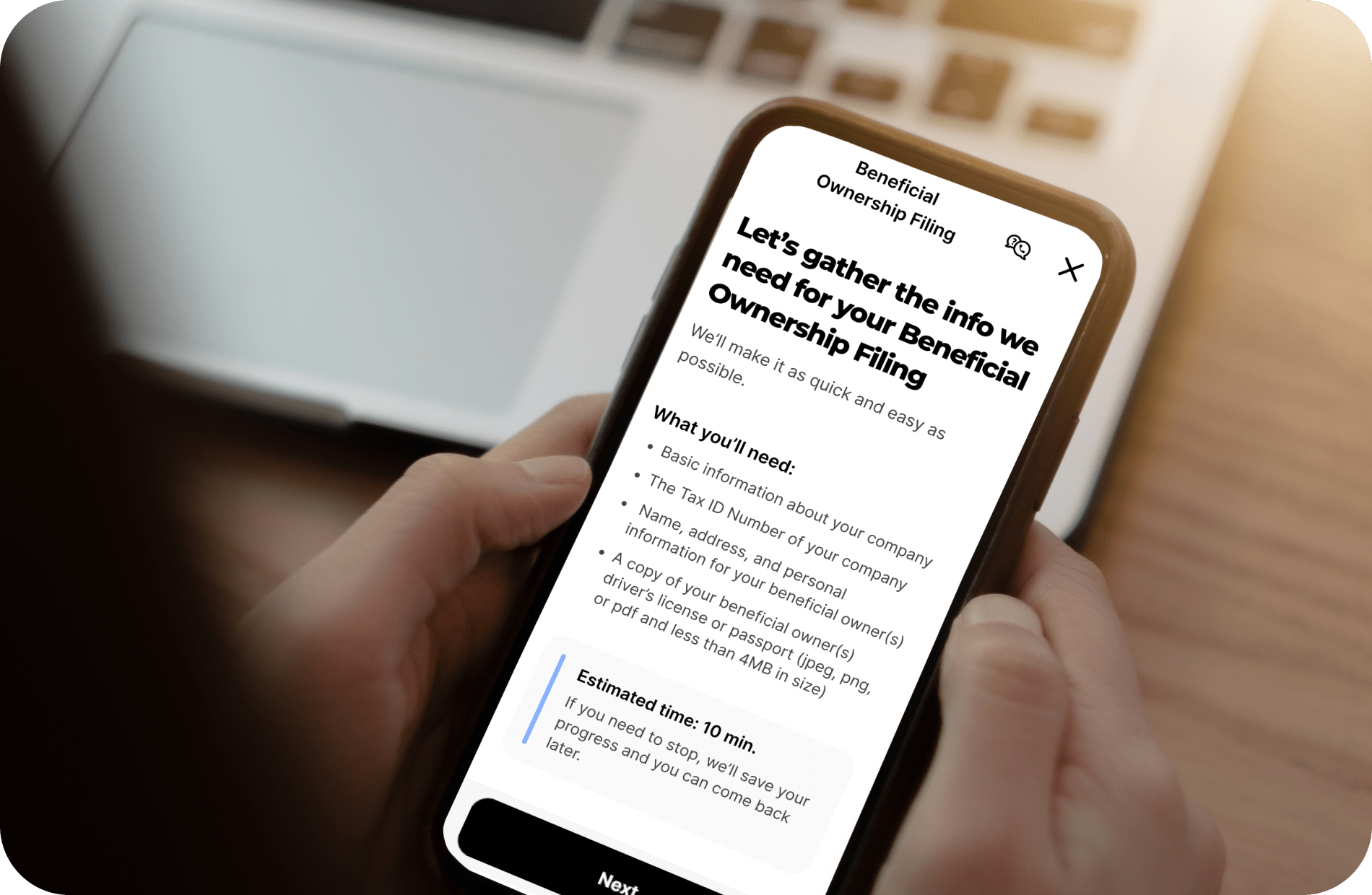

3. Collect Necessary Information

Deadline: 12-17-2024

Prepare the following:

-

Company Details: Name, EIN, and address.

-

Owner Details: Names, addresses, dates of birth, and valid ID information.

4. Submit Your BOI Report

Deadlines:

-

Existing companies: 01/01/2025

-

New businesses (2024): Within 90 days of registration

-

New businesses (2025+): Within 30 days of registration

ZenBusiness offers tools to streamline the BOI filing process—check them out.

Important Information for Boardman Businesses

Who Needs to File?

“Reporting companies” include LLCs and corporations formed in the U.S. Exemptions apply to certain groups, such as nonprofits and banks. For instance, a family-owned coffee shop in Boardman would likely need to file.

Defining Beneficial Owners

Beneficial owners meet one or both criteria:

-

They own 25% or more of the company.

-

They hold substantial decision-making power in company operations.

Example: A local bakery with two partners, each owning 50%, must report both as beneficial owners.

What Information is Required?

BOI reports must include:

-

Company Information: Legal name, EIN, and address.

-

Beneficial Owners: Names, residential addresses, dates of birth, and ID details.

How to File and Deadlines

Reports must be submitted electronically to FinCEN:

-

Existing entities: 01/01/2025

-

Businesses formed in 2024: 90 days after formation

-

Businesses formed in 2025 or later: 30 days after formation

Penalties for Late or False Filings

Failure to file or providing inaccurate information may result in:

-

$500 daily fines

-

Criminal penalties

Errors can be corrected within FinCEN’s 90-day safe harbor period.

Why ZenBusiness?

ZenBusiness specializes in BOI reporting, offering expertise and efficiency to help businesses meet compliance requirements. Save time and ensure accuracy by starting your BOI filing today.

Additional Resources for Filing

Act today to avoid fines and ensure your business remains in compliance—file your BOI report before the 01/01/2025 deadline!